What is compound interest?

It is often repeated that none other than Albert Einstein is said to have referred to compound interest as “the eighth wonder of the world.”

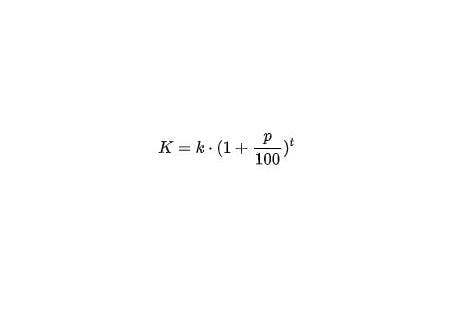

Compound interest is a means of growth, and is not hard to understand: it is the interest that is earned on interest. When you invest a certain amount of money, interest on it slowly starts to accrue in the same way that the total outstanding amount of a loan, for example, increases due to the accumulation of interest. The difference, however, is in who benefits: in the case of a loan you pay interest to the bank, whereas with an investment the interest is added to your investment capital.

Compound interest really starts to come into its own over a longer period. After a year or so, you’ll start to see some results as interest starts to compound on the amount you invested.

How compound interest works can be better understood by way of an example.

Let’s say you start by investing €500 in a fund. If the interest rate were 5%, a year later you would have €525. This amount will increase again by 5%, leaving you with €551.25 after another year. And after a third year, the amount will be €578.81.

So, even if you do not add to the investment, by compounding over the course of time the interest rate will increase the return on your investment, for as long as you keep your capital and the accumulating returns on it invested.